Ashburton Gold Project

With gold prices reaching all-time highs in 2025, the Ashburton Gold Project is emerging as one of Australia’s most compelling gold developments.

A Scoping Study delivered in November 2025, focused on the Mt Olympus Deposit, highlighted the potential for the AGP to become a high-margin, cashflow-generating gold operation in the world-class Western Australia mining jurisdiction.

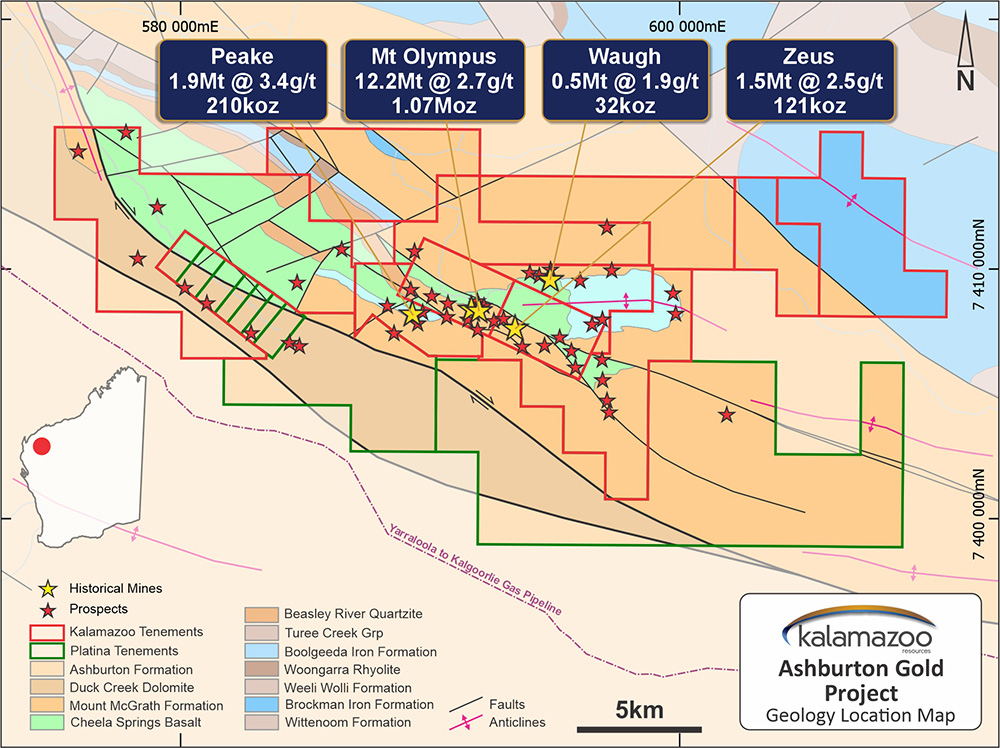

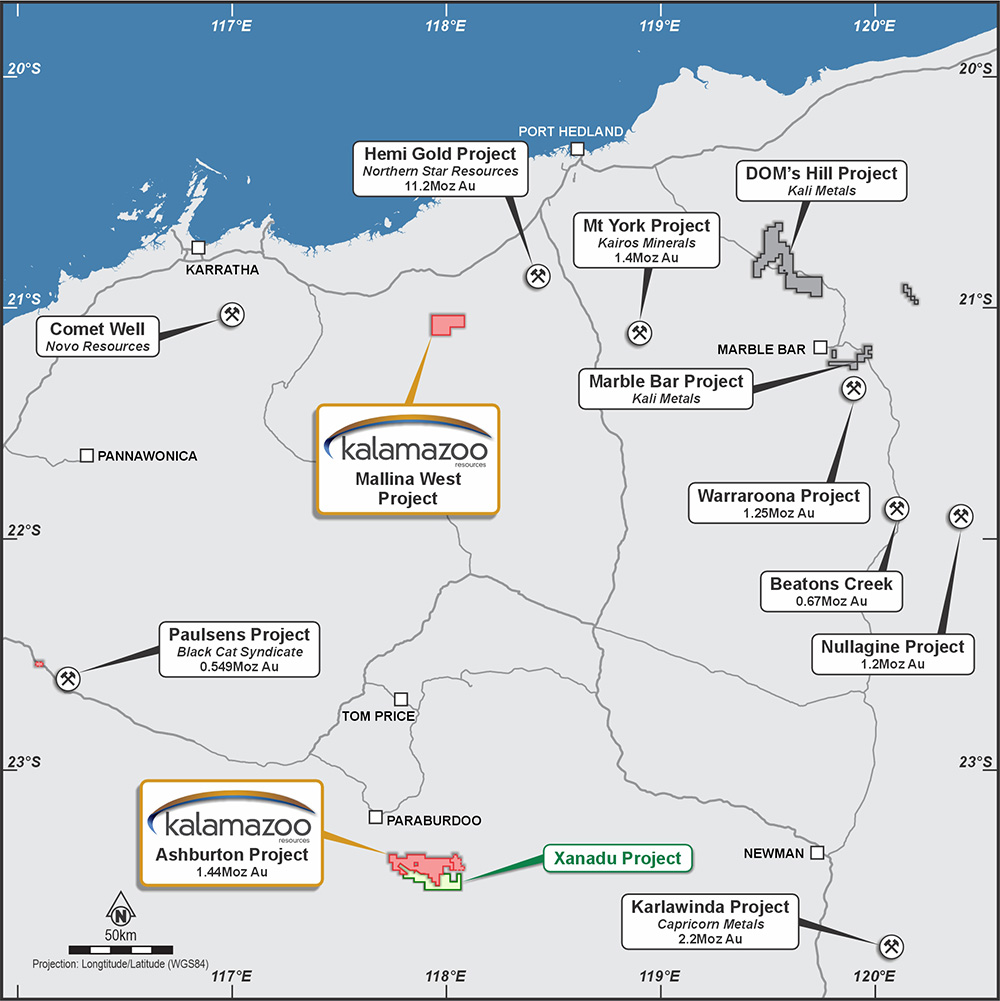

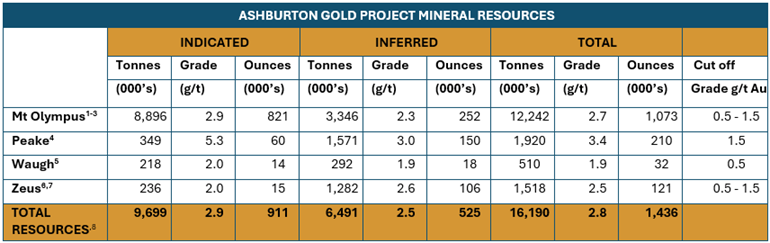

Located on the southern edge of the Pilbara Craton, Kalamazoo acquired the AGP from Northern Star Resources (ASX: NST) in 2020. In 2023, Kalamazoo updated the Mineral Resource Estimate to 16.2Mt @ 2.8g/t Au for 1.44Moz (JORC Code 2012). This increase represented a 10% increase in grade across the resource base and 68% increase in the Indicated Category ounces. The MRE includes mineralised materials across four deposits at the AGP with the Mt Olympus Deposit accounting for 75% of total resource base ounces.

The Scoping Study, which assessed the optimal development pathway for the Mt Olympus Deposit, returned the following compelling highlights:

- Projected total recoverable gold of approximately 524,000oz over a 73-month Life-of-Mine (LOM) at an All-in-Sustaining Cost (AISC) of approximately $2,183/oz

- Higher gold prices demonstrate substantial upside, with pre-tax free cashflow rising from approximately $747M at the conservative Base Case of $4,500/oz to $1.396B at $6,000/oz, NPV8% rising from ~$423M to ~$842M, and with IRR lifting from ~47% to ~74% respectively

- A simple 1.5Mtpa crush, grind, rougher, multistage, re-clean flotation circuit has been identified as the optimal strategy to produce a high grade ~25g/t gold concentrate at 86% processing recovery

- Total pre-production capital expenditure of approximately $208m forecast to be repaid in ~23 months

- Additional significant underground resources and exploration targets of approximately 350,000 – 500,000oz1 recently identified below the Mt Olympus open pit are not included in the Study, positioning Ashburton as a potentially long-life regional-scale development

A Pre-feasibility Study is underway to evaluate the pathway to production for one of Australia’s most promising gold projects in a record-high price environment.

Project Expansion

Based on exploration work over the past five years, Kalamazoo believes there is potential to substantially increase the gold inventory and life-of-mine at AGP.

The 2025 Scoping Study results are only the foundation case for the AGP. The Company’s re-optimisation of the existing 174,500ozi underground resource at Mt Olympus, combined with a newly defined underground Exploration Target, demonstrate the potential for an additional ~350,000–500,000oz below the open pit.

Kalamazoo is now focused on converting the 17% of Inferred Resources within the Mt Olympus open pit to the Indicated category, whilst advancing the underground opportunity into a JORC-compliant resource, alongside the existing 363,000oz resources at Zeus, Waugh and Peake Deposits.

Kalamazoo will progress the AGP Pre-Feasibility Study during 2026 to fast-track the project towards production.

In September 2025, Kalamazoo announced an agreement with Platina Resources (ASX: PGM) to acquire the Xanadu Gold Project. This project is a valued addition to Kalamazoo’s project portfolio, comprising nine highly prospective exploration tenements which are contiguous with and along strike southeast of AGP. The Xanadu acquisition is a key part of Kalamazoo’s regional growth strategy, aimed at adding gold resources from brownfield and greenfield prospects surrounding the Mt Olympus Deposit.

The wider Ashburton-Xanadu Gold Project covers an area of 380.2km2.

Mineral Resource Estimate for the Ashburton Gold Project¹

- OP (Open Pit) resource: >0.5 g/t, inside optimised pit Rev factor = 1.2

- UG (Underground) resource: >1.5g/t below Rev factor = 1.2 pit, inside domain wireframes

- West Olympus OP: >0.5 g/t, inside optimised pit Rev factor = 1.2

- UG: >1.5g/t below Rev factor = 1.2 pit, inside domain wireframes

- OP: >0.5g/t above 395mRL (equivalent to base of current pit)

- OP: Optimised Pit 11 with Indicated + Inferred, > 0.5g/t

- UG: Below Optimised pit >1.5g/t

- The previous inferred resource at Romulus remains unchanged at 329kt @ 2.6g/t for 27k oz Au. Romulus was not included in this update and is therefore in addition to the total Resource quoted in the above table1

The updated 2023 MRE and pit optimisations for the AGP were based on the then current gold price of AUD$2,600/oz and consists of 16.2Mt at 2.8g/t Au for 1.44Moz across four Mining Leases. The resource includes mineralised material from four deposits, with the large and important Mt Olympus Deposit accounting for 75% of the total resource base ounces. In terms of value-adding, this updated resource estimate delivered a 10% increase in grade (2.8 g/t Au), as well as a 68% increase in the higher-confidence Indicated Category ounces. Refer to the 2023 MRE statement for the Mineral Resource Estimate – Summary of Material Information.