Ashburton Gold Project

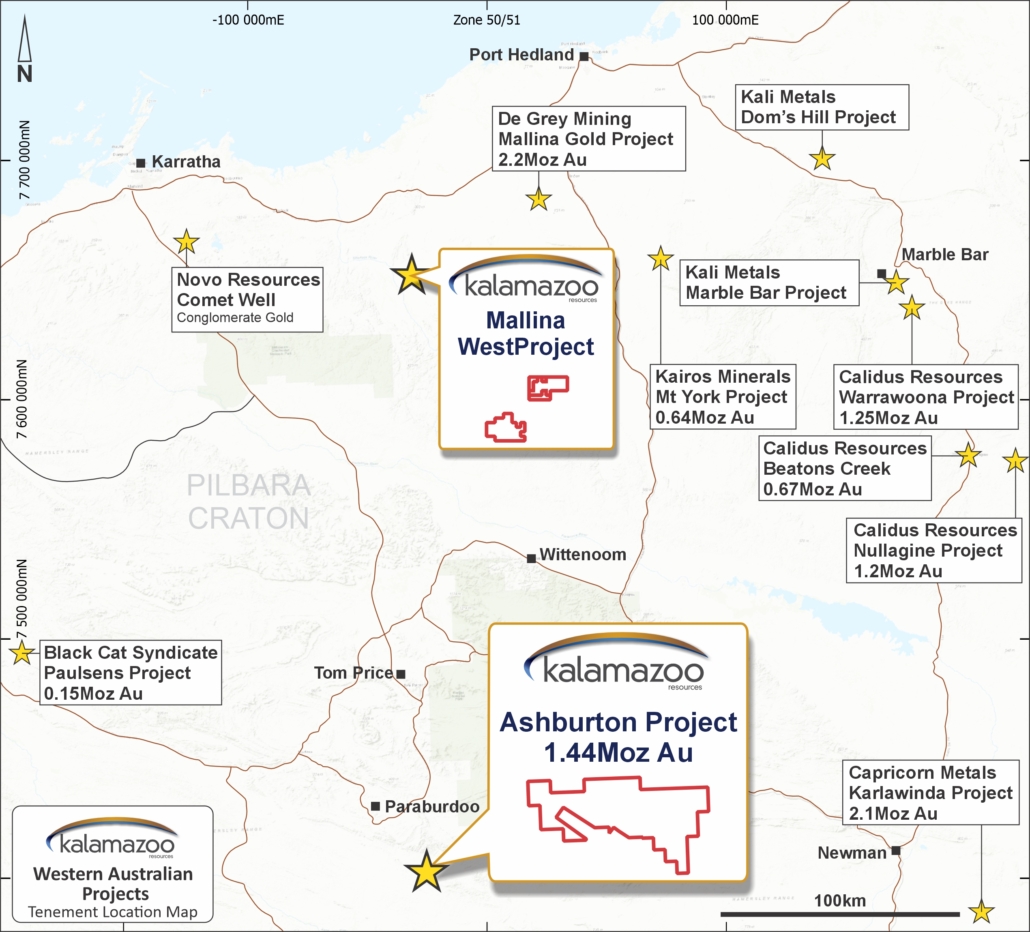

Kalamazoo acquired its Ashburton Gold Project from Northern Star Resources Limited (ASX: NST) in 2020. Covering 217km2, the Ashburton Gold Project is located on the southern edge of the Pilbara Craton in Western Australia, with historical gold production of 350,000oz Au (1998-2004).

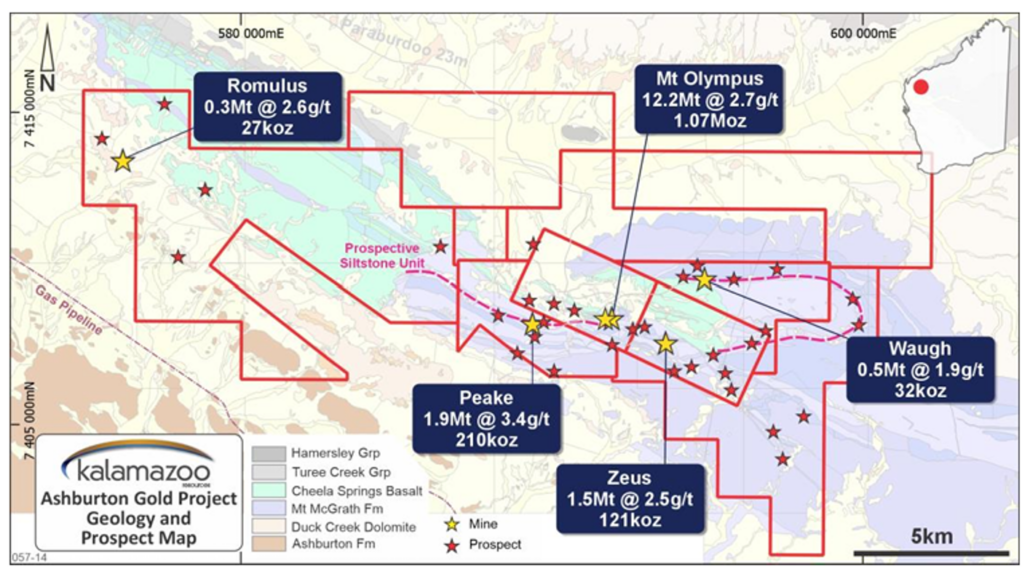

The Ashburton Gold Project currently contains a Mineral Resource estimate (JORC Code 2012) of 16.2Mt @ 2.8g/t Au for 1.44Moz. Located within the Ashburton region on the southern edge of the Pilbara Craton and just south of the iron ore towns of Paraburdoo and Tom Price, the Ashburton Gold Project is ideally located close to existing mining service companies and to the gas pipeline which passes within one kilometre of the southern edge of the project area.

The Project comprises 4 Mining Leases (M52/639, M52/640, M52/734 and M52/735), 4 Exploration Licences 52/1941, 52/3024, 52/3025, 52/4052 and 2 Tenement Applications 47/4714 and 47/4913.

Project History

Sipa Resources Limited (ASX:SRI) (“Sipa”) discovered four deposits at Ashburton – Mt Olympus (including West Olympus), Zeus, Peake, and Waugh during 1996/97.

Together these four open pits produced approximately 350,000oz of gold from 3.2Mt of oxide (and minor transition) ore at an average grade of 3.3g/t Au between December 1998 and April 2004 (Figure 2). The majority of the gold came from Mt Olympus which produced 242,000oz of gold from 2.5Mt at an average grade of 3g/t Au, with a recovery of 92% and a strip ratio of 3:1.

The onsite plant was sold in 2006 and site rehabilitation was completed in 2007.

Sipa and Newcrest Limited (ASX:NCM) entered into Farm-in and Joint Venture Agreements in June 1998 covering all Sipa’s tenements, except the Mount Olympus, Zeus, Peake, and Waugh deposits. Newcrest withdrew from the project in May 2009 after spending more than $20 million, with estimates that 60% of this expenditure was spent on field activities.

Northern Star acquired the Ashburton Gold Project from Sipa in February 2011 and went on to complete exploration and drill programs in 2012 and 2013.

In 2013 Northern Star released an updated Mineral Resource estimate which expanded the Mineral Resource JORC Code (2012) to 20.79Mt @ 2.45g/t for 1.65M oz Au.

In 2023, Kalamazoo released an updated Mineral Resource estimate which updated the Mineral Resource JORC Code (2012) to 16.2Mt @ 2.8g/t Au for 1.44M oz.

Figure 2. Mineral Resources and exploration targets at Kalamazoo’s Ashburton Gold Project

Figure 1: Location map of the Ashburton Gold Project relative to Kalamazoos Pilbara Projects

Aerial view of the Ashburton Gold Project with Mt Olympus open pit in mid-ground and rehabilitated tails dam

Geology

The Mt Olympus, Peake and Zeus gold deposits are situated within the Neerambah Complex of the Lower Proterozoic Wyloo Group, on the southern and faulted margin of the Diligence Dome.

Each of the deposits is typified by sericite alteration and bleaching, and sometimes silicification, with highly elevated arsenic (As), antimony (Sb) and other gold pathfinder elements.

Sipa and Northern Star have both previously reported that their preferred gold exploration model for the Ashburton Gold Project is for sediment hosted Carlin-style mineralisation.

The Ashburton Basin shares several similarities with the Carlin trend (>110Moz of past production and Reserves) of the Great Basin in Nevada including:

- Carbonates and carbonaceous siltstones

- Evidence of de-calcification of dolomite and limestone units

- Au-As-Sb-Hg geochemical signature

- Silicification and jasperoid development

- Mineralised structures (possible feeders)

- Evidence of intrusive activity

Figure 3. Aerial view of the West Olympus open Pit, looking northwest

Mineral Resources Estimate

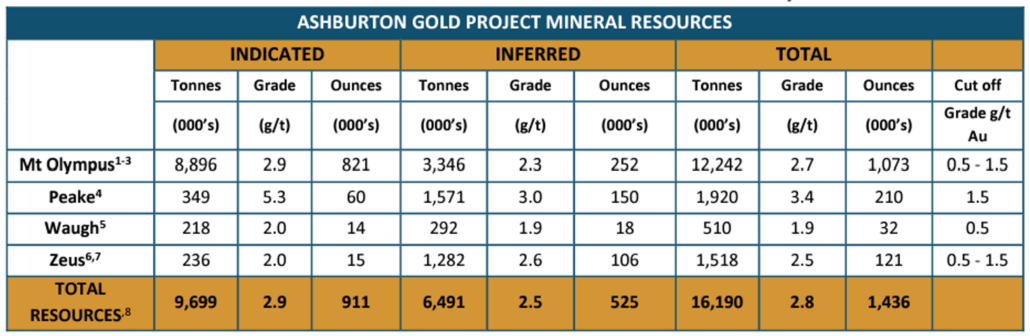

In February 2023, Kalamazoo announced the results of an independent mineral resource estimate for Ashburton which now stands at 16.2Mt @ 2.8g/t for 1.44Moz. The resource includes mineralised material from four deposits, with the large and important Mt Olympus deposit now accounting for 75% of the total resource base ounces.

The updated resource shows a 10% uplift in grade over the previous estimate (although this represents a 13% decrease in total ounces across the four deposits). The increase has chiefly resulted from a change in the interpretation of the major lodes at the important Mt Olympus deposit, which has resulted in an increased in confidence in the orientation and continuity of the higher-grade gold mineralisation.

Consequently, there is a significant increase in the proportion of Indicated material to Inferred material at Mt Olympus compared to the previous estimate and a very significant 24% increase in grade, now estimated at 2.7g/t Au (previously 2.2g/t Au). Overall ounces at Mt Olympus remain essentially the same.

Figure 6. Mineral Resource Estimate for the Ashburton Gold Project